Sometimes it can be difficult to save money. We don’t like saving money, we want to spend it! After all, we work hard to earn it, right?

And while this is true, saving money should be a priority for you and your money. Reserve money for your emergency fund, your vacation fund, children’s college funds, retirement, buying a new home, and anything else you want to save money for.

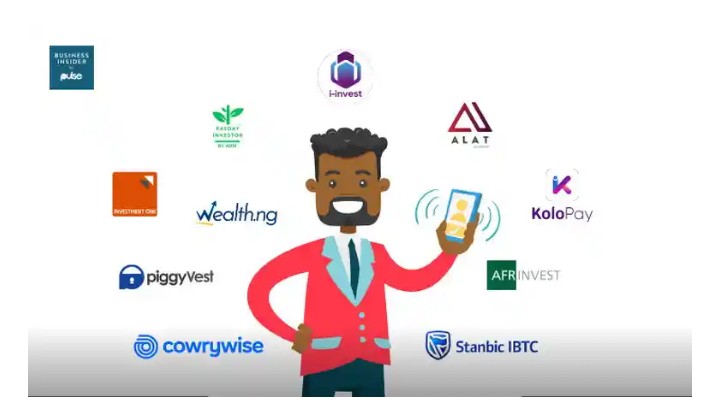

And sometimes it’s hard to get into the savings mindset. That is why I found these amazing savings applications! A list of good applications and self discipline is just what you might need to help hold your hand and show you how easy it can be to save a lot of money in no time.

And the good thing is that this applications allows you to also invest.

Best Savings Apps In Nigeria

PiggyVest

PiggyVest was first launched in January 2016 as a savings platform under the name Piggybank, in 2019 the name was changed to PiggyVest. PiggyVest is the first “Savings and Investment” app in West Africa, offering customers direct investment opportunities and savings. This means that in the PiggyVest app, you can save and also invest everything at the same time. With PiggyVest, you can save up to 50 Naira per day, and there is no maximum amount.

PiggyVest offers its clients between 10 percent to 15 percent interest on savings and more than 25% return on investments. When using the PiggyVest app or website, users use their debit card details to transfer money or set up an automatic save instruction to periodically fund their accounts. You provide a designated bank account for your withdrawals, and it takes 10-15 minutes for that account to be credited.

A 5% fee is charged for withdrawals from your Piggywallet account on days other than established withdrawal days, while withdrawals from your Flex accounts are free. With the Piggybank Flex dollar account, you can also finance your savings, invest and transfer funds in US dollars. The target saving and secure locking features in PiggyVest allow you to lock some funds until you need them.

With Investify by PiggyVest, you can invest in low-risk and pre-risk primary and secondary investment opportunities. Additional PiggyVest protection ensures that your investments are protected, preventing losses.

The PiggyVest app is available to download from the Apple and Google Play Store.

CowryWise

Launched in 2017, Cowrywise offers clients savings and investment opportunities. With an interest rate of up to 15% on savings, CowryWise hits the list of the top 5 savings platforms in Nigeria. You can choose to automatically save a specific amount periodically or use the unique savings feature to deposit funds to your account whenever you want.

CowryWise accepts all debit cards issued by Nigerian banks and has a minimum savings amount of 100 naira with no limit up to a maximum amount. Your savings are blocked for at least 90 days with no maximum time limit. Interest is paid on your savings every day at midnight.

CowryWise offers different savings plans designed for different circumstances. They understand:

Save circle: this function allows you to save a group among your family and friends. This helps them save for a specific project or goal.

Regular plan: with the regular plan, you can choose to automate your savings at regular intervals or save as you wish. You can only withdraw from it on the due date, and you earn interest while it remains.

Life objectives: they are better suited to long-term financial objectives and have a duration of at least one year.

Halal Savings: This plan is similar to the regular plan, but without interest, it targets Muslims who want to save without getting interest.

Save time: this feature allows you to reconstruct your existing plans whenever you want.

Withdrawals can only be made on the specified due date, and you can choose to withdraw all or part of your savings and interest. Withdrawals are made directly to the bank account you specified under “Banks and cards.”

CowryWise is available for Android and iOS.

ALAT by WEMA Bank

Launched in 2017, as a digital bank account, your ALAT account is opened in a few minutes, and you can set a savings goal in terms of time and amount. With ALAT, you have received a physical debit card to make cash withdrawals, but you can choose to delay this option.

With ALAT by WEMA Bank, you can earn money through referrals.

By using the targets function, you can set aside specific amounts according to our schedule. This comes with a 10% interest on the amount saved per year. ALAT works like a regular bank account and you can carry out other transactions without entering a physical bank.

ALAT is available on Android and iOS platforms.

ESUSU

This application is literally the digital version of our good old traditional collective savings system “Ajo” or “Esusu.” You can save with a group of friends or family and take it in turns every few months.

It has the added value of letting other people hold you accountable.

SMARTSAVER

SmartSaver is an online savings and investment platform that aims to make savings easier, smarter, more convenient, and more secure. They use Paystack for all their payments, and their funds are stored in FCMB.

Set your savings goal and focus on a daily, weekly or monthly basis. The withdrawal is quarterly, and your money pays much higher interest than what you get in a regular bank savings account.

SmartSaver’s investment savings yield up to 30 percent per year, while its SuperSave product pays up to percent per year, quarterly at 2 percent per quarter.

SmartSaver users benefit from getting an unsecured loan.

REACH

This is a personal finance application that helps you develop financial discipline by tracking your income, monitoring your spending and helping you make smart money decisions. Forbes describes Reach as a Nigerian fintech who helps him save for the big moments of life.

Using an algorithm, the app tracks your SMS alerts and uses it to generate detailed personal financial management information to give you a breakdown of where your money is going each week, information about your spending and a budget tool to help you reach your financial goals.

This fintech currently supports 17 banks in Nigeria and Ghana.

Download the Reach app from the Google Play Store.

KUDIMONEY

This platform automates your savings. Link your debit account to your Kudi money account and set up your savings plan, such as daily, weekly or monthly. Kudi money savings is automatically deducted from your bank account on the due date and credited to your savings account with an interest rate of up to 10% per year.

The Kudi Money Spend account works like a checking account, as it allows you to withdraw at any time and there is no minimum balance. But unlike your current account, you earn 3% interest per year, accumulated daily on your balances.

Kudimoney Savings and Spending Account Users Are Eligible For Low Interest Loans

RIBY

An online savings and investment platform designed to help individuals and small businesses save, invest and borrow money at high interest rates. The platform includes modules for different market segments:

Riby Cooperative meets the need for cooperatives, associations and business groups that help them manage members’ contributions, savings and loans; Riby Peer loans, which allow peer-to-peer loans, and the Riby Saver application, which allows users to automate their savings.

- XCARET100 – Perfect tool for Carding - February 7, 2024

- ELON MUSK yahoo format – Download - February 2, 2024

- CARDRO PRO – For Carding, Bvn hack, fake alert. - February 2, 2024